Fears sparked by the bankruptcy of Silicon Valley Bank, which have led to a request for help from Credit Suisse from the Swiss National Bank and a liquidity injection from 11 US banks to First Republic Bank over fears of liquidity shortages, do not appear to have worked on the cryptocurrency market , especially bitcoin. All the more so since the bankruptcy of the US regional bank Signature Bank points directly to this market and the US judiciary has requested that the purchase agreement between Voyager and Binance US, the US subsidiary of the largest exchange in the world, be settled pending disputes, legal SEC Objections Filed.

Since Silicon Valley Bank’s closure was announced on March 10, Bitcoin is up more than 26.5%, hitting levels not seen since 2022.

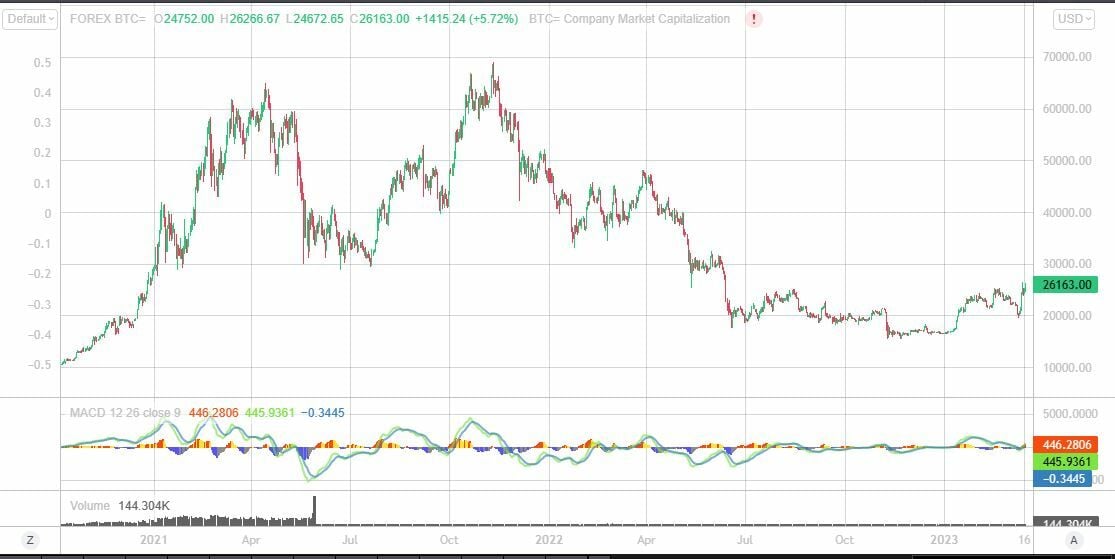

Development of Bitcoin in the year with MACD and trading volume. Source: Reuters

Close shorts or assess your fundamentals?

An increase that, according to experts, can be due to various causes. The first, the Fed and US Treasury injection of funds into Silicon Valley Bank to avoid a systemic crisis in an environment where investors continue to see the prospect of a lower interest rate scenario as an incentive to bet on these cryptocurrencies in a particularly hectic banking context and fear of contagion everywhere. And after all, some say so Behind the dynamics of the major cryptocurrencies lies the fact that traders have made large hedging trades against a foreseeable upcoming price drop when the price was around $20,000 and the surge could be due to a brief closure.

That’s what Morgan Stanley promised this week This should be the time to “shine” cryptocurrency. as concerns grow about traditional banks, especially considering Bitcoin was intended as a way for people to hold value in a private digital wallet without having to call in an intermediary to store it for them or who will provide it to you enabled transactions to be carried out.

In practice, Bitcoin “is not isolated from the traditional banking system” as it Its price is supported by “dollar-denominated bank liquidity, making it act as a speculative asset rather than a currency.”, the report persisted. In their view, this week’s rally was driven by a small number of market participants and likely benefited by short pinching rather than a “significant change in trading momentum,” the report added. (A short squeeze occurs when an asset rises in price and short investors are forced to cover their positions at a loss.)

Regardless of the reasons behind this surge, which has already accumulated more than 57% year-to-date, it is still a long way from the levels reached in 2022, when levels as high as $100,000 were expected to be the target for the cryptocurrency. The interest rate hikes initiated by the central banks hit financial assets and Bitcoin with particular force. And it so happens that contrary to the original idea, bitcoin has a positive correlation with risky assets.

Bitcoin development since 2021 with MACD and trading volume. Source: Reuters

“In general, a period of bitcoin dominance is seen as a healthy factor for the cryptocurrency market, as it indicates that conditions in the market are relatively low (cryptocurrency traders are choosing to buy bitcoin over other altcoins). speculative,” said FundStrat Research. In a tweet on Tuesday, FundStrat said the rally may reflect investor interest in Bitcoin “resurfacing at a time when traditional banks like SVB are failing.”

Levels to look out for in Bitcoin

With this in mind, is it time to buy Bitcoin? Mónica Triana and Carlos Gil, trading analysts for investment strategiesThey believe it is crucial that Bitcoin closes the week above $25,050 while Ethereum needs to remain above $1,675. “If this happens, we could see the bullish move taking bitcoin to 28,000 hold. From that level, we would need to see what the two cryptocurrencies are doing: they can return to $31,800 and $1,950 respectively if they are converging to the upside, or they can see lower levels if they are diverging.”

Short term Ramón Bermejo, Market Strategist He asserts that Bitcoin “had an inside bar figure for the past two sessions, the shooting star had confirmed it but had stopped falling and inside bar validation points to the upper side of the rising figure at $26,937.” See full analysis

Technical Bitcoin Analysis. Source: Bloomberg

On the 60 minute chart“tested the critical point, but did not violate it in the end of the day therefore the HCH number has not been validated. Bearish symptoms would come if it describes a double top or double top with bulltrap that loses the trendline and breaches $24,061.03 in a new attempt.