Shares of Repsol are up more than 6% (market level) for the week that ended yesterday, just as the Ibex 35 is up more than 0.9%. Since the dips a week earlier – when it touched levels of $14.30 – the value has rallied strongly even above the oil price itself.

Javier Lorenzo, GPM manager he recognizes that it’s a value he likes and is interesting to have in his portfolio. “As long as it doesn’t lose the €13 level, it is a clear hold with resistance at €15.50.”

Has a less optimistic view Antonio Espín, independent analyst who believes that the value has had several attempts to break the 15.50 euros without making it and loses support. “Oil companies are regular and not that cheap in my opinion, although they may have support at $13. So if they want to take positions, they can do so at $14.40 with a stop at $12.80.” See: What could be a good entry price for Repsol?

The truth is that despite last week’s gains, the company is down a little over 4% year-to-date. A penalty that has removed it from the consensus average target price of $20.00, which represents a potential above current prices of 26.68%. Of the 29 analysts covering the stock, 23 recommend the company as a buy or strong buy, versus 6 who remain neutral.

Repsol, with a significant spread between value and price

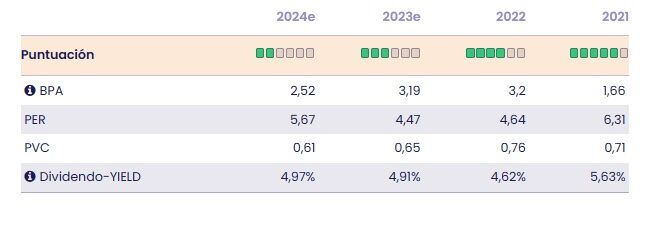

At a basic level, with a EPS forecast of EUR 3.19 at the end of 2023 “Repsol has a significant spread between value and price. The market is discounting a P/E of 4.8x, very cheap compared to the average for the Ibex 35 and its peers,” said María Mira, fundamental analyst at Investment Strategies.

The discount also comes at the EV/EBITDA multiple (2.13v) and the market is paying just 0.7 times book value. Dividend yield higher than 4.5% and healthy balance sheet.

The company has made a clear and firm decision to undertake the transition as part of its long-term strategic plan, and its entire strategic plan has been realigned to reflect that strategy. In this sense, the Spanish group is also committed internationally to gas, in wind and solar projects. An ambitious plan is underway to increase renewable capacity from 3 GW in 2019 to 7.5 GW in 2025 and with the ultimate target of 15 GW in 2030.

The group will double the production of high-quality biofuels from vegetable oils (HVO) to up to 600,000 tons per year in 2030, half of which will be produced from waste before 2025. Repsol also started selling renewable energy and gas in Portugal. A highly concentrated market, led by EDP with 74% market share, Iberdrola 5.6%, Galp 5.4% and Endesa 8.9% and others 6.1%.

Repsol has confirmed that its cash compensation will increase by 11% in 2023 to up to €0.70 gross per share, which is above the 2024 target set in the strategic plan. In January it already paid EUR 0.35 gross per share and will now add an additional payment of EUR 0.35 gross per share after the approval of this year’s Annual General Meeting. See: Repsol: The Group creates value and receives it from shareholders.