Gold has gained strength in the market in recent sessions after the Federal Reserve hiked rates by a quarter of a point but signaled it was on the verge of a pause. Falling prices increase the attractiveness of bars, which do not earn interest.

Added to this are the insolvency of the American Silicon Valley Bank (SVB) and the subsequent rescue of Credit Suisse, which was taken over by UBS, alongside the problems of other medium-sized banks in the USA, including the controversial liquidation of the holders of coconuts (convertible bonds) of Credit Suisse, which are the risk priority to stocks have caused investors to feel some anxiety and sought refuge in assets such as gold.

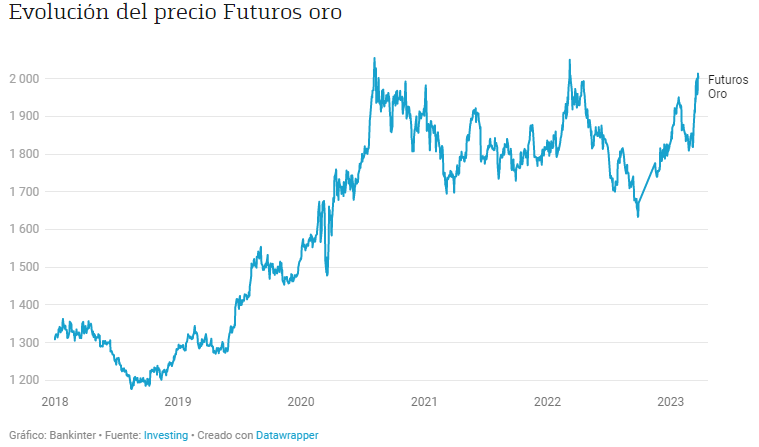

“Many people claim in the age of monetary excess that gold is worthless, but that is not true, it is worth as a decorrelated asset when bonds and stocks are absolutely correlated with a completely equivalent trend of expansion and currency contraction. “Gold shows the risk of stagflation and the risk of a possible crisis,” Tressi’s chief economist said in an interview. exceeded the $2,000 mark per ounce for the first time last year. Last year the price changed little and was $1,820.

This Monday, however, gold loses the 2,000 level and is currently trading at They subtract 1.15% from $1,978 an ounce, given the respite from contagion fears for the markets. And Federal Reserve officials said on Friday there was no sign of financial stress worsening, a fact that has allowed them to remain focused on reducing inflation by raising interest rates again.

Gold Price Prediction 2023-2024

Additionally, Bankinter’s analytics department released a report today on their gold futures forecast for 2023 and 2024.

Specifically, the estimated estimate for the price of an ounce of gold for December 2023 is $1,900 an ouncewhile it’s for 2024 $1,700 an ounce.