IBEX-35 banks are trying to recover from the setback caused by the US regional bank crisis, which began in March with the collapse of Silicon Valley Bank and then engulfed other Wall Street companies . The risk of contagion in Europe may be limited, but some banks, particularly small and medium-sized ones, were more affected.

Added to this is, among other things, the uncertainty following the elections in Turkey, which has affected BBVA. Nonetheless, the company, chaired by Carlos Torres Vila, remains the company to have risen the most in the IBEX 35 so far this year.

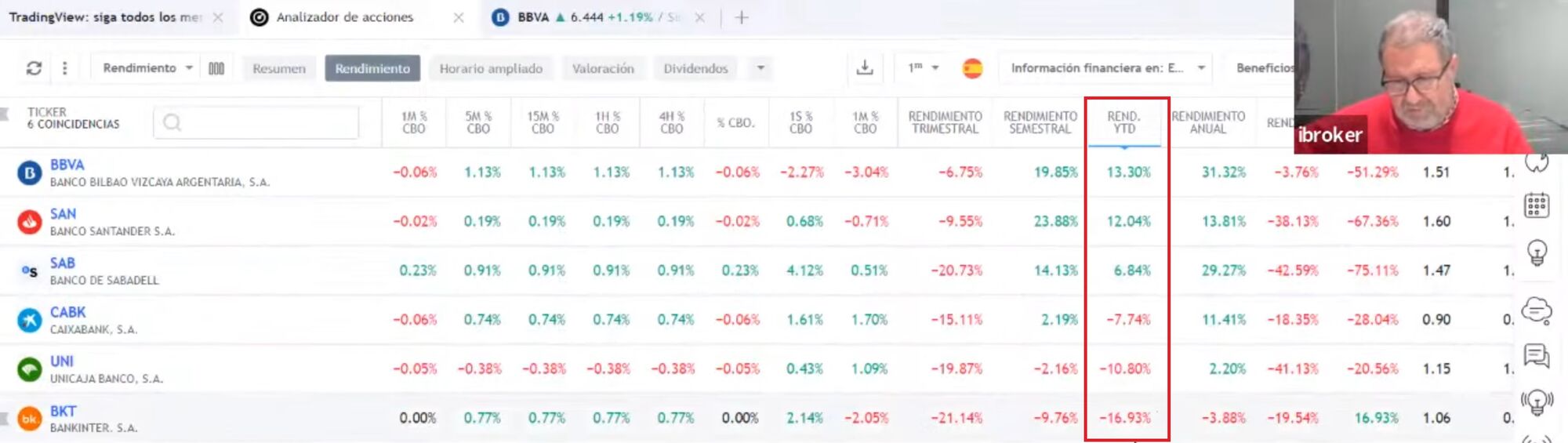

On the other hand, in this exercise, the smallest banks are penalized and the one that accumulates the most penalties is Bankinter, as we can see in the image below.

The company is down nearly 17% so far this year in the Ibex 35. Still, for Antonio Castelo, market specialist at iBroker, it’s a strong bank with positive prospects that “doesn’t deserve this performance.”

Thanks to the interest Margin growth remains strong And they will continue to do so next year because, well, European Central Bank interest rates have yet to rise. “I think they still have at least a few climbs to go,” says Castelo.

Here’s how Bankinter has moved in the stock market over the past three years since the pandemic began:

Bankinter has achieved a 63% improvement in interest margin, well ahead of the rest of the Spanish banks on the Ibex 35. It reaches a value of 5,222 million euros compared to 320 in 2022. It was also the bank with the highest return Die Difference between fees for customer loans and payments for deposits has improved.

Despite the analyst’s upbeat outlook, the Premium Strength Indicators of Investment Strategies for Bankinter shows the value is “very weak.”

What can be affect your offer show this poor performance so far this year? The price is practically the same. Some analysts have pointed to an implied loss in the fixed income portfolio that could amount to around 1,000 million euros. They also point to the negative development of loans and retail deposits with decreases in the first quarter compared to the previous quarter of 1.6 and 1.2%.

The Reuters consensus has a price target of €7.52 for Bankinter, which represents a 43% upside potential.