Turkey’s current President, Recep Tayyip Erdogan, will be forced to beat opposition leader Kemal Kiliçdaroglu in the May 28 elections, who managed to force a second round of Turkey’s presidential election after winning a percentage of almost 45% had achieved. of the vote in the May 14 elections, compared to the 49.5% that Erdogan received. A priori, the incumbent president is considered the favorite for this Sunday after being supported by Sinan Ogan, the third candidate who was eliminated on the first ballot and received the remaining 5% of the votes.

The results reflect recent instability in the country. In recent years, the Turkish lira has lost a lot of value and has had to accept a significant devaluation. In 2018, the country’s currency was trading at 5 lira per euro. Today, five years later, one euro is equivalent to just over 21 lire, the lowest level in its history. If we look back over the last 10 years, the Turkish lira has risen from 1.85 liras against the dollar to 19.76 liras per US bill.

In turn, the country is caught in an inflationary spiral, fueled by the Turkish central bank’s constant interest-rate cuts. Inflation exceeded 80% at the end of 2022And at the moment is set in values over 40%.

The fact that interest rates are being lowered instead of following the recommendations of experts who insist on lowering interest rates in the face of high inflation rates has stimulated factors such as consumption, production or exports and created a feeling of growth at the expense of very high inflation rates.

Mapfre faces the challenge of a hyperinflationary economy

The Turkish market is one of the main areas of activity for some Spanish companies such as BBVA. 13% of the Group’s margins and 9% of its assets come from this market. In fact, the company’s current CEO Onur Genç was born and raised in the Anatolian country. The financial company has been present in Turkey since 2010 and after 13 years its presence has become even more noticeable through its subsidiary Garanti.

After the official release of a necessary second round to determine the country’s political future, shares of the financial institution fell about 4.5% in the two days following the IBEX 35 election.

For Mapfre, Türkiye accounts for 1.5% of the total volume, a percentage that has declined in recent years. In 2018, for example, this rose to 2.3%, which is 0.8% more than current percentages.

The insurer presented its results for the first quarter of 2023 at the end of April last year and announced that revenue had risen by 20.5% to 9,121 million euros compared to the same period last year.

However, the company’s net income, run by Antonio Huertas Mejías, fell 17.4% year-on-year to just under 128 million euros. The insurance company attributes that number to the impact of the earthquake in Turkey, which it estimates had a net cost of 77 million, in addition to a “complicated automotive environment”. “The earthquake in Turkey was the main catastrophic event affecting results and the estimate, pending a full damage assessment, is for an impact of approximately €77 million on net results.”

That in turn was stated by the company Turkey’s result in 2022 shows a loss of 40.3 million eurosThey emphasize that this is due to effects such as “an increase in the accident rate in the automobile sector due to high inflation in the country, which has a significant impact on the average cost of claims” and the “Reformulation due to hyperinflation to be applied to the country’s financial statements”, and which had a negative impact of 16.6 million euros as of December last year. Last year, the insurance company covered losses incurred in the transcontinental country, a fact that stands in contrast to 2021, when Mapfre declared Turkey a hyperinflationary economy.

Turkey’s economic indicators continue to show a negative development for the company, which is reflected in a continuous devaluation of the currency against the euro. This circumstance has had a cumulative negative effect on Mapfre’s consolidated equity of around 360 million euros in recent years, “due to the currency-related loss in value of the subsidiary in Germany”.

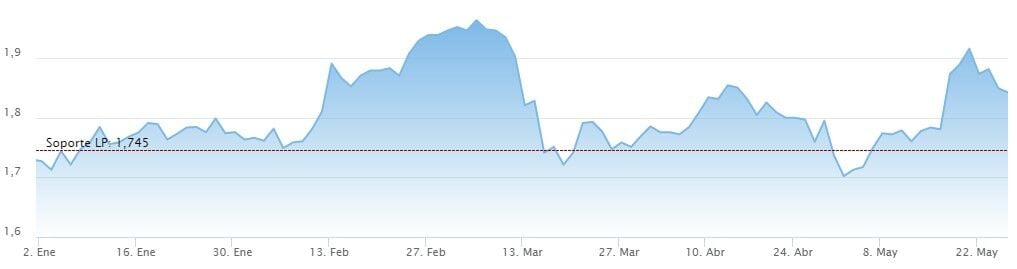

The value is up 6.55% so far this year and is priced at €1.84.

Analysis for investing.

Register for free in Investment Strategies and Discover the most bullish stocks on the stock market right now. Adjusted prices, good fundamentals and bullish trend.

Some Values currently have a potential of 50% in the stock market.

You will also receive our stock market analysis newsletter, our favorite securities tools and our free training courses. Register here for free.