Despite Friday’s decline, Melia Hotels is seeing a more than positive few months on the IBEX 35. This is reflected in the data as it is positioned as one of the top three Spanish picks to gain the most in 2023. Specifically, the hotel company cumulates an annual growth of more than 37%, surpassed only by Amadeus and Inditex.

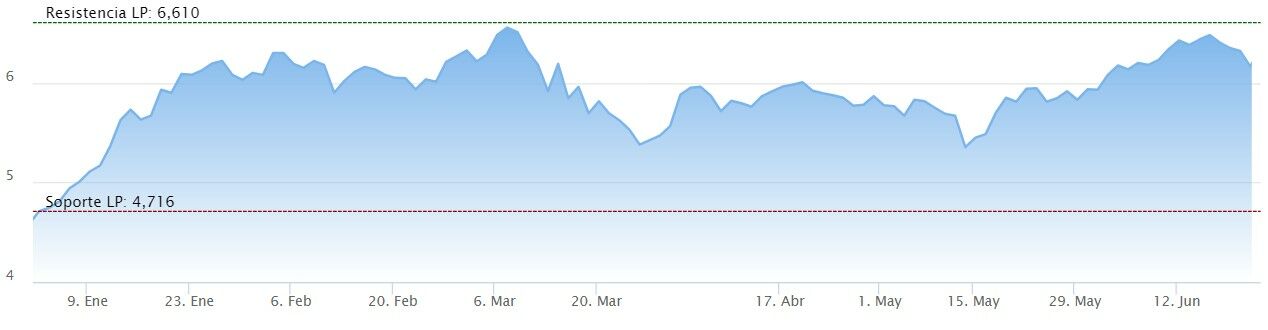

This Friday, Deutsche Bank reviewed its prospects for Melia Hotels, raising the company’s target price by 11.8% from €5.9 to the current €6.60 and giving the Spanish company a rating 12-month potential of 4%.

Criterion that follows a line very similar to that of the Reuters analyst consensuswhich gives Melia Hotels potential 3.27%, with a price target for its shares of EUR 6.47. Additionally, of the 15 analysts covering the company, 33% recommend buying the shares, 47% recommend holding and the remaining 20% recommend selling the stock.

On Thursday morning, the replacement of the group’s chairmanship was announced, as Gabriel Escarrer Juliá had submitted his resignation as head of the company and will be replaced by his son Gabriel Escarrer Jaume, who until then had held the position of vice president and CEO, since he took over the post will continue to hold.

In addition, at last Thursday’s Annual General Meeting in Palma, the company announced that it intends to increase its Ebitda, or gross operating profit more than 10% compared to 2022 data, a year that ended with a value of 430.8 million euros. Gabriel Escarrer recalled that last year he had promised to reach an EBITDA of 400 million, “a target that has been greatly exceeded” and that the company could try to go one step further.

In doing so, the company feels strongly committed to “one more time beating the market consensus” and achieve an Ebitda value of “up to 475 million euros” in 2023, according to the group’s CEO. In return, the intention was announced to sign 30 new hotels in different parts of the world, totaling 8,000 rooms.

The news marked a reversal in the stock market for the company as the Ibex 35 rallied after four straight days of losses. It closed up 3% on Thursday, although it fell again on Friday.