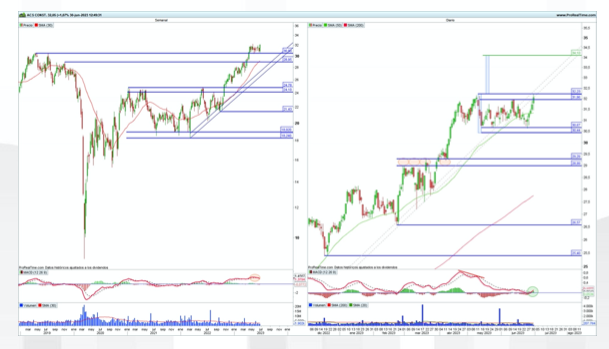

ACS: new opportunities for new bullish targets

ACS, a leader in the financial sector, is pursuing an aggressive strategy by directly attacking the upper contract band in its lateral processue is in a price range of approximately €32.23 to €31.96 per share. Breaking this barrier has become the priority objective after successfully normalizing accumulated overbought levels on the daily MACD oscillator. This action demonstrates ACS’ determination to maintain its uptrend.

The financial analyst team assumes that exceeding this limit would open up new opportunities for ACS, pThis leads to an update of the next bullish targets which would point to €34.10 per share. It is important to underline that in the current context the company has managed to keep downside risks under control as long as the key support level at €30.44 per share is not breached.

This strategic move by ACS reflects its confidence in the upside potential and determination to maximize results for its investors. Analysts believe that the company has demonstrated the ability to navigate the accumulated overbought levels, which underpins its bullish stance and bolsters the prospects for upside in the short to medium term. However, one is advised to closely monitor the development of the market and ACS’s ability to sustain its position above the mentioned support level as it will influence the future performance of the stock.

Unicaja: when floors become resilient

Unicaja Banco, a leader in the financial sector, managed to break through the intermediate resistance at €0.9585 per share. This advance was possible thanks to two key factors: first, the normalization of the overshoots observed on the weekly MACD oscillator, indicating greater stability in the market; on second place, support from the solid long-term bullish guideline who supported the action. This milestone is significant and represents a prime bullish scenario for Unicaja.

The strategic focus is now a bullish rotation towards the zone of previous levels that acted as floors but are now turning into resistance, in the price range of €1,079 to €1,049 per share. However, it is important to note that the stock needs to stay above the support area currently set between $0.8937 and $0.8770 per share to avoid a breakout that could change the landscape and lead to a bearish scenario.

Seasoned analysts believe that Unicaja has shown strength in the market and its ability to break through key resistances. The normalization of the technical indicators and the support of the long-term bullish outlook support the company’s bullish outlook. However yesContinuous monitoring of market developments and support levels is recommended. as this has an impact on the future performance of the share. Investors need to assess risk carefully and have a solid strategy in place to take advantage of the opportunities in the market.

Logistics: with underlying bullish strength

Logista, a leader in the logistics industry, has again reached the area of significant resistance, located around €24.86 / €24.55 per share. Breaking this resistance is the scenario that veteran financial analysts prioritize, especially against the backdrop of major underlying bullish strength. Importantly, Logista has managed to remove readings of bullish excesses, particularly overbought ones, without jeopardizing the underlying bullish structure.

In the short-term, technical analysis suggests that the first signs of weakness will not appear until Logista breaks the €23 per share support level. This suggests that the stock is on a positive path and has a strong position in the market. Logista’s ability to clear key resistance levels and consolidate above it is an indicator of its long-term upside potential.

Investors and financial analysts are closely monitoring Logista’s performance, taking into account underlying bullish strength and technical signals emerging from analysis of resistance and support. Breaking the resistance at the mentioned levels would open the door for new bullish targets. However, it is important to keep an eye on support levels and watch for signs of weakness in the short-term. Maintaining a sound investment strategy and carefully assessing risks are critical to capitalizing on opportunities in the Logista stock market.

Analysis for investing

Register for free in Investment Strategies and Discover the most bullish stocks on the stock market right now. Adjusted prices, good fundamentals and bullish trend.

Some Values currently have a potential of 50% in the stock market.

You will also receive our stock market analysis newsletter, our favorite securities tools and our free training courses. Register here for free.