Amadeus, the company that has risen the most this year in the IBEX 35 with an annual increase of almost 44%, is not the stock that has recorded the strongest in the entire Spanish stock market in 2023. In fact, it is a company in the continuous market that achieves a fivefold increase in this figure.

This is Tubos Reunidos, a Basque industrial company Sees its shares up 230% year-to-date and if we are in the middle of the year, it is the value of the 130 that make up the continuous market that will appreciate the most in 2023.

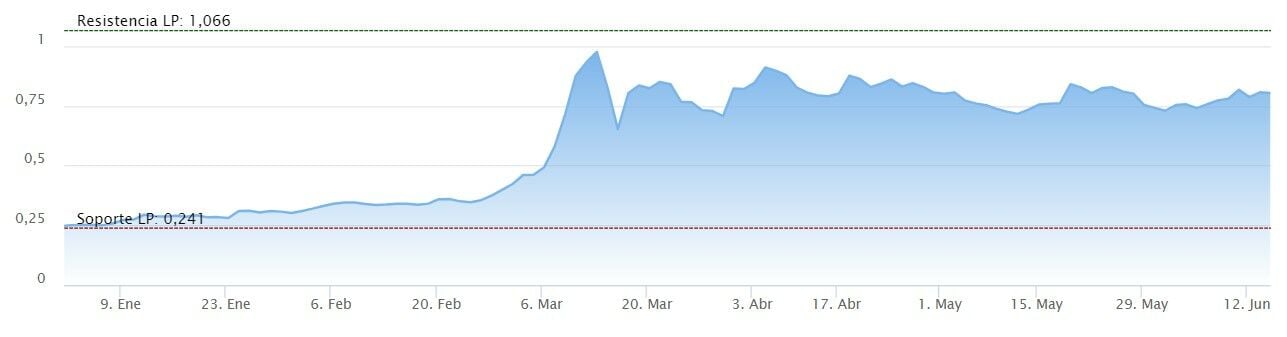

This increase in the value of their shares became even more and reached almost 300% in March last yearto be able to remove the label at certain times penny stick (securities trading under one euro) when a price of 1,050 euros is reached.

Thereafter, Tubos Reunidos titles could no longer maintain these numbers and began to decline, however, always maintaining more than substantial annual gains. In last Thursday’s session, it closed up almost a percentage point, while Friday morning’s rise reached 3.20%. An increase that is not surprising given that Tubos Reunidos shares recorded a value of more than 10% in the last month, although the month of May ended with several days of declines in the stock market

This fiscal year, the company has managed to resume the uptrend it lost in 2022 when it fell 12.14%, which was a standstill after recovering over the following three years: 37.25% on the year 2021, more than 6% in 2020 and 34.2% in 2019.

Reasons behind the re-rating of the company’s shares include the company’s return to profitability after several years of declines and the company’s low exposure to the American market, particularly the United States, where tariffs would adversely affect the company’s operations.

As for the IBEX 35, as previously mentioned, the company with the highest annual gains is Amadeus, registering 44% in 2023. The technology solutions company has since seen how Reuters analyst consensus have raised their price target by 7.5% in the last three months.

The valuation has thus risen from EUR 63.52 in March to currently EUR 68.28. Of course, the experts give the company a negative potential of -2.29%. Still, more than 50% of the analysts monitoring Amadeus’ behavior recommend buying its stocks.