One of the most reliable indicators for measuring the liquidity of a company is the so-called LCR (Liquidity Coverage Ratio)calculated as the percentage obtained by dividing the bank’s pool of high-quality assets (including deposits with the central bank, corporate bonds or covered bonds) by the estimated total net cash outflows in a stressed situation over the next 30 calendar days.

This coefficient, which is part of the Basel III agreements, must be at least 100% to ensure this The company’s risk profile is adequate to survive a full month in the eye of the hurricane. And the two big Spanish banks, Banco Santander and BBVA, far outperform them.

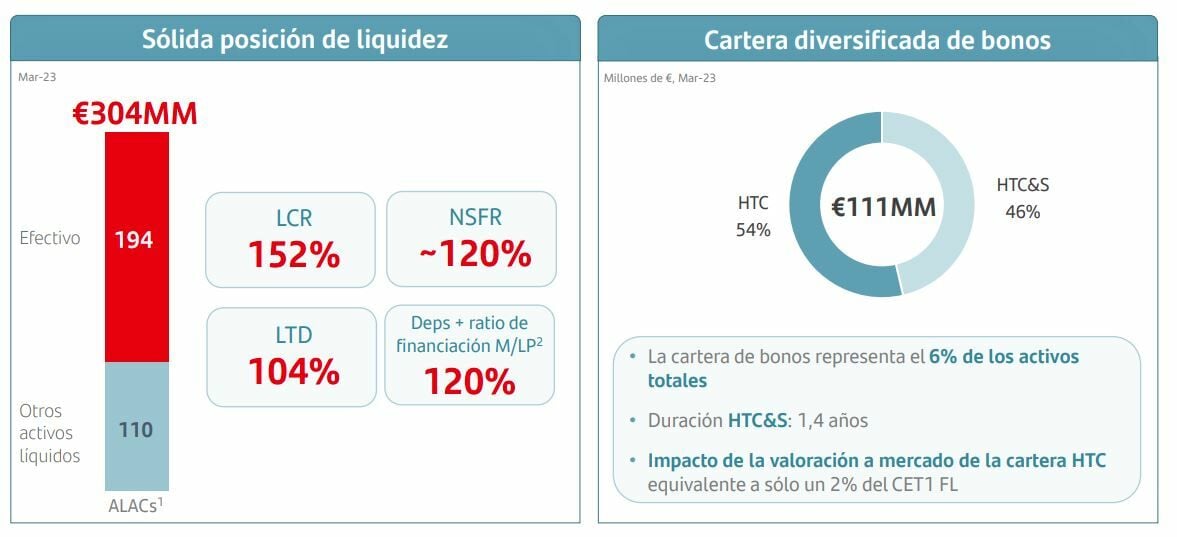

In the case of Banco Santander, the Coverage was 152%, as at the end of 2022, at the end of the first quarter, according to quarterly results released this morning. The same is true for the Net Stable Funding Ratio (NSFR), which measures the level of stable funding a bank needs to cover loans with maturities longer than one year, which was 120%.

In its financial report, the bank led by Ana Botín highlights that the liquidity buffer, consisting of high-quality liquid assets (HQLA), exceeded 300,000 million euros at the end of March 2023, of which almost 200,000 million were in cash. which is 20% of the bank’s deposit base.

Client deposits grew 5% to €1.12 trillion, thanks to growth in deposits (+6%) across all regions, supported by both individual clients and Santander Corporate & Investment Banking (Santander CIB). Deposits fell 2% sequentially on seasonal declines at Santander CIB in January; From February onwards, however, total deposits began to rise again, a testament to the good course of business.

Santander also points out that 85% of the bank’s deposits come from individuals and companies, and about 80% of deposits from individuals are insured by deposit guarantee schemes.

When measuring the liquidity metrics of BBVA, the other major Spanish bank, one caveat needs to be considered. Due to its subsidiary management model, it is one of the few major European banks to follow it Multiple Point of Entry (MPE) resolution strategy.: The parent company sets the liquidity policies, but the subsidiaries are self-sufficient and responsible for managing their liquidity and funding (accepting deposits or accessing the market with their own rating) without any funds being transferred or cross-funded from the parent to subsidiaries or between subsidiaries .

BBVA points out that this strategy “limits the spread of a liquidity crisis between the different areas and guarantees the appropriate transfer of liquidity and funding costs to the pricing process”. However, the Carlos Torres-led bank boasts in its financial report that it maintains a solid liquidity position in each of the geographic areas in which it operates, presenting metrics well above the required minimum.

The consolidated LCR of the group remained well above 100% in 2022, reaching 142% as of March 31, 2023. It must be taken into account that given the MPE nature of BBVA mentioned above, this ratio limits the numerator of the 100% LCR of subsidiaries other than BBVA, SA. Therefore, the resulting ratio is lower than that of the individual entities (the LCR of the main components reaches 161% in BBVA SA, 188% in Mexico and 217% in Turkey). Without considering this constraint, the Group’s CSF ratio would reach 184%. On the other hand, as of March 31, 2023, the NSFR was 132%.