BBVA remains one of the most reliable banks on the IBEX 35 in 2023 cumulative increase of 21.25%and positions itself as the financial company with the highest annual growth of the Spanish selection.

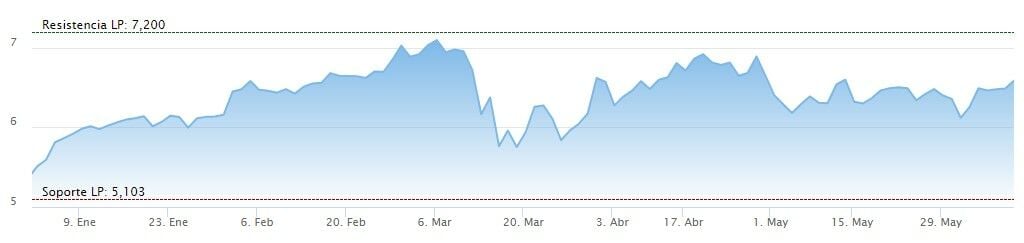

The past few weeks have been more positive for the bank than initially anticipated due to the company’s heavy exposure to Turkey and the instability that has emerged in the country in recent weeks. Still, BBVA shares 6.4% is recorded in this month of Juneand practically 4% if we go back a month.

The Turkish market is one of BBVA’s main areas of activity. 13% of the Group’s margins and 9% of its assets come from this market. The rapprochement with the Ottoman country is made all the more apparent when you consider that the company’s current CEO, Onur Genç, was born and raised in the Anatolian country.

The financial company has been present in Turkey since 2010 and after 13 years its presence has become even more noticeable through its subsidiary Garanti.

After the official announcement of a necessary second round to determine the country’s political future, the financial company’s shares in the IBEX 35 fell about 4.5% in the two days after the first round of voting.

A similar situation was experienced by the Spanish bank after the second round on May 28th, a fact analyzed by Araceli of fruitswhich affirms that “with the new Erdogan’s re-election, BBVA, was severely punished for the collapse of the Turkish lira, and what he suffered in the days that followed was the reinstatement of the previous penalty. In the three days following Turkey’s election, the company’s shares fell just over 5%, only to recover in the sessions immediately following. As of Friday morning, shares of the company lost about 0.8%.

He Reuters analyst consensus gives the financial institution a 12-month potential over 24%In addition, the company has raised its price target by 7.35% in the last three months from EUR 7.61 in March to currently EUR 8.17.

Among the experts covering and analyzing the situation of the company managed by Carlos Torres, there is a clear consensus not to sell their stocks: 56% are determined to buy BBVA shares and the remaining 44% prefer to hold.

He BBVA’s current P/E is 5.88, below the Ibex 35 average, which currently stands at 9.76. Comparing the data with other competing companies, Banco Santander currently has a P/E ratio of 6.43 and Caixabank 8.42.

Earnings per share (EPS) is 1.12. The current PVC (book value price) is 0.75. For their part dividend yield from BBVA is located in the 6.53%what that data is the highest among the Capricorn bankswhich is above the dividend yield of Banco Santander (4.07%) and Caixabank (6.32%) for reference.