The DOW JONES falls 0.52% to 34,035 points, while the S&P 500 falls 0.02% to 4,367 points. The NASDAQ 100 returned 0.13% to 13,555 points.

The market had a bullish session yesterday, Tuesday, with the Dow Jones up 0.4%, the S&P 500 up 0.7% and the Nasdaq up 0.8%. These last two indices hit their highest levels since April in the regular session, encouraged by better-than-expected CPI data.

Today’s inflation moderation trend is confirmed by May producer prices. As reported by the Department of Labor, Producer price index fell 0.3% for the month, beating the 0.1% decline forecast by the Dow Jones. Final consumer goods prices fell 1.6%, accounting for most of the decline. Ex-Food & Energy, the core PPI rose 0.2% in line with the estimate.

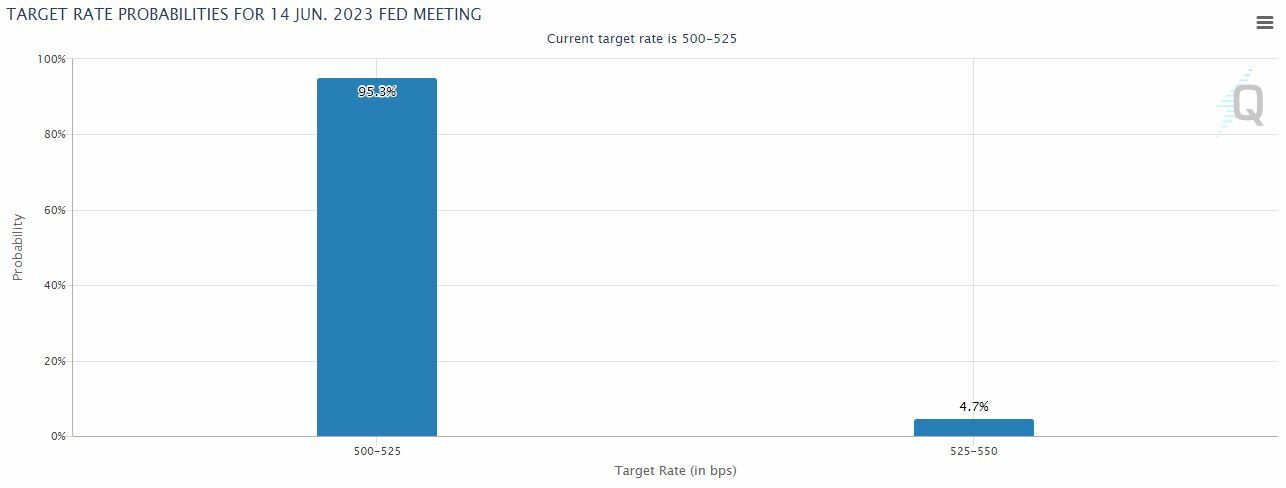

But all eyes are on the Federal Reserve meeting. markets are coming 95% chance the central bank will keep rates on hold at current target of 5% to 5.25%, according to CME Group’s FedWatch tool. That would mean a pause from rate hikes after a streak of ten straight hikes that began in March last year.

Aside from the announcement by the Fed itself, investors are also eagerly awaiting comment from Chair Jerome Powell in case he offers further clues on future moves. For now, the market is inclined to temporarily take today’s break and announce a fresh 25-point increase in July.

“Price developments are good, but we still believe that much needs to be done to contain inflation. Therefore, we do not rule out that the Fed will be forced to act again if this variable does not behave as expected,” he points out. Juan J. Fernández-Figares, of Link Management. “Now it’s also true that before proceeding, the Fed is ‘obliged’ to ‘stop’ to review what impact its rate hikes are having on the country’s economy: growth, jobs and prices.”

“It can be done,” warns the expert If the Fed leaves rates unchanged today, but hints at raising them further if necessary, markets, which have been positive in recent meetings, will correct slightly“.

In bond markets, which are always very sensitive to changes in monetary policy, Powell expects bond yields to trend down. The benchmark 10-year yield fell three points to 3.808%, while the benchmark two-year yield fell four points to 4.656%.

Investors need to pay attention to Walt Disney’s price today. The entertainment giant announced a reorganization of its release calendar yesterday Tuesday. Delay of several films from the Avatar, Marvel and Star Wars franchises.

The company has not provided details of the decisions made to change the release dates, although the changes come at a time when the writers’ strike is crippling the film and television industries and causing production halts that could impact release plans.

In the semiconductor industry, Advanced Micro Devices isn’t content to let NVIDIA capitalize on the AI boom. The company has announced that it will begin shipping its MI300X GPU chip to some of its customers later this year. Companies like OpenAI use GPUs to develop AI programs. AMD CEO Lisa Su told investors that artificial intelligence is the “biggest and most strategic long-term growth opportunity.” However, AMD still has a lot of catching up to do: Nvidia dominates the AI chip area with a market share of over 80%.

As for analyst recommendations, Goldman Sachs leaves Boeing a buy recommendation with a price target of $291, which is assuming an appreciation potential of more than 32%. The delivery numbers were strong in May, wrote analyst Noah Poponak.

Good news for Netflix, too, after Barclays raised its price target from $250 to $375, but left the rating at “in-line”.

Lumen Tech shoots up more than 10% on the ground after rising 16% before the bell. Investors seem to have welcomed Lumen’s new network ecosystem in partnership with Google (Alphabet) and Microsoft.

In commodity markets, oil prices rose, with West Texas futures up 1.08% to $70.38 a barrel. Brent crude was up 1.17% to $75.39. According to the International Energy Agency (IEA), global oil demand growth will come to a near standstill in the coming years, peaking in this decade as Chinese consumption slows after an initial recovery.

“The transition to a clean energy economy is accelerating, and global oil demand is expected to peak before the end of this decade as electric vehicles, energy efficiency and other technologies advance,” he said in a statement by IEA Executive Director Fatih Birol.

The euro is up 0.14% against the dollar, hitting $1.0808 for each common currency.