On the same Wednesday, analysts at the Canadian bank Royal Bank of Canada (RBC) increased Inditex’s price target from previously 30 to 32 euros. With the new valuation of RBC, the capitalization of Inditex in the Ibex 35 would be almost 100,000 million euros (99,733 million). Banco Sabadell this Thursday raised the fashion company’s price target by 14% to €33 per share, which corresponds to a company valuation of €102,849 million.

“We expect solid comparable revenue performance with a 13% quarter-on-quarter increase from less to more, a strong start to the fourth quarter and an increase in pricing, and comparatively benefit from the impact of Omicron in the fourth quarter of 2021.” say the experts of the Catalan bank Banco Santander sees its shares at 35.70 euros per share, HSBC at 34 euros, Caixabank BPI at 33.60 euros, BNP Paribas and Oddo BHF at 33 euros per share They all believe that Inditex is worth more than 100,000 million on the stock exchange.

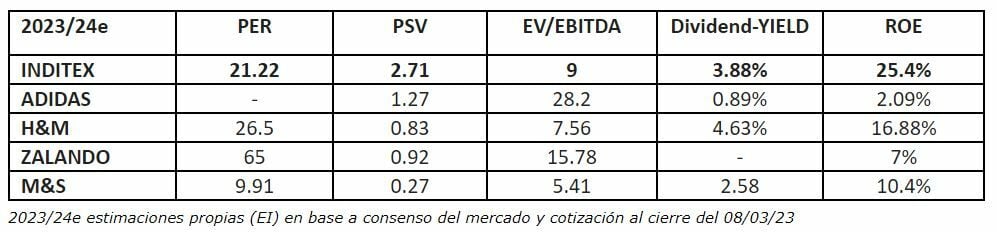

The analyst consensus sees the price target at EUR 30.46 per share, which gives it an upside potential of 4.6% and has 21 buy ratings, eight to hold and just one to sell. At a fundamental level, Inditex achieves these results with a dividend yield of 3.88%. It trades at 23.6 times earnings-PER, but analysts think it could end the year at 21.22 times. It is the European textile with the highest financial return (ROE) of 25.4% compared to 16.88% at H&M.

“Due to fiscal year-end multiples and underestimates through January 2024, the market is paying 21.2x P/E for Inditex, compared to 26.5V for H&M, 65V for Zalando or market-estimated red for Adidas; by EV/EBITDA Inditex is also trading at a discount, 9V for the Galician textile company, compared to more than 28V for Adidas, 15.7V for Zalando and 7.5V for H&M. Inditex also has a return on equity, ROE, one of the highest at 25.4%, compared to 16.8% for H&M, 7% for Zalando, 10.4% for M&S or 2.09% for Adidas. My assessment is therefore positive for Inditex, under fundamental analysis criteria and for an investment with a long-term horizon,” says María Mira, analyst at Investment Strategies.

On a technical level, it “maintains an undeniable growing structure that, despite the accumulation of readings of bullish excesses or accumulated overbought readings, increases the risk of a correction. With this in mind, we will not appreciate a technical deterioration of the short term until we are we.” Witnessing the perforation of the growing guideline emerging from the September lows, as well as the last rising low forecast of €27.59 per share,” comments Investment Strategies technical analyst José Antonio González, down just 1.24% the pre-pandemic peak of €29,546 on February 19, 2020.

Dividend increase by 30%

“My balance sheet is consistently positive, I’ve always liked the company and Pablo Isla has left the Executive Board looking to the future. I think Marta Ortega will follow a line of continuity and the brand image at the international level is crucial at this point, more luxurious than what we have in Spain. At the cost level, it is very well managed, it has the ability to pass them on to the price and gives priority to the digital channel. Inditex’s results are certainly goodthe macro environment is in their favour, as other competing companies are more leveraged and the Russian challenge is already forgotten,” said Rafael Ojeda, global macro analyst at Fortage Funds.

Inditex is expected to close the 2022 financial year with a historic profit of 4,161 million euros, with an increase of 28%, and at the sales level, the increase is estimated at 17% to 32,439 million, despite the exit from the Russian market, which was loud before the war Consensus 8.5% of operating profit Bloomberg.

| revaluation in the year | 18.15% |

| Revaluation last 12 months | 29.68% |

| PER | 21.22x |

| dividend | 3.88% |

| target price | €30.46 |

| potential | 4.60% |

The fashion company raised prices in its main markets twice during the year to counter inflation: in March they rose by 2% in Spain and Portugal and by 5% in the rest of the markets, and in the autumn they returned another 5% increase. Inditex has also started charging online returns during these months to cover transport costs or get customers to their physical stores.

“At the end of the fiscal year through January 2023, I think the numbers will be good. Sales should have ended the year dynamically, according to strength through October. The impact of inflation on costs is expected to be less than revenue growth, demonstrating an optimization of spending that will favor margin improvement. The well-executed strategic focus on digitization, sustainability and growth should, and in fact already is, creating value easily .She has resolved her exit from Russia and for this side the risk is mitigated, with some provisions that already seem more than sufficient,” adds Mira.

“Last drop, an enviable balance sheet that hasn’t been affected at all by interest rate escalation. Inditex’s net liquidity allows it to pay an exceptional interim dividend, maintain a high level of investments and implement its strategic plan without major concerns for the financing side and face the difficulties that arise in a 2023 that remains complex at a global level”, he comments.

The company, managed by Marta Ortega, will not change its dividend distribution policy on its net profit (“pay-out”), which stands at 60%, but these profits allow dividends to be increased by up to 30%, taking into account those announced at the last general meeting announced special dividend of EUR 0.40 and an ordinary payout of between EUR 0.79 and EUR 0.80 per share. The dividend charged to profit for 2021 was EUR 0.93Therefore, the shareholder remuneration is to increase by 30%. Consensus expects earnings per share to grow 30.82% to €1.23.