The whales of ripple help to increase trading volume with view on Resolution of the case against the US Securities and Exchange Commission (SEC).. This volume has climbed towards $1 trillion in the last 24 hoursaccordingly Simon Chandler at Crypto News.

XRP now has down 5% in a weekbut has up 5% in the last 30 days and 61% in the last 12 monthsas anticipation mounts for Ripple’s protracted legal battle with the SEC.

This anticipation is also evident in XRP’s 24-hour trading volume, which has increased to $1 trillion todayafter I spent nearly $500 million over the weekend.

There are signs of this too Some whales may accumulate XRP before the case finds the next resolutionwhich is expected in the coming weeks and could push the price of the altcoin higher.

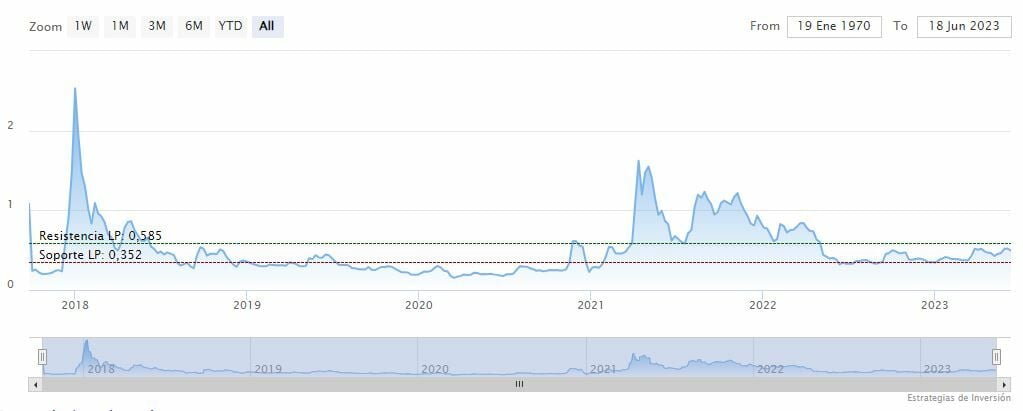

The XRP chart suggests that this could be due to one soon a clearer recoverywith its indicators poised to recover from oversold positions.

Its Relative Strength Index (purple) is back up to 50 after being closer to 30 at the end of last week, suggesting it is slowly regaining some momentum.

At the same time, XRP’s 30-day moving average (yellow) fell below its 200-day moving average (blue) for a few days, so it could potentially bounce back up soon.

Supporting this positive outlook is the fact that the altcoin’s (green) support level is rising, meaning that XRP has fallen as low as it can be during this trying time and is poised for a rebound.

SEC Conclusion

Such a perspective is certainly supported by XRP’s fundamentals as Ripple nears the conclusion of its case with the SEC.

More importantly, recent developments suggest so The cryptocurrency company has a good chance of seeing an outcome favorable to it to the extent that it allows you to continue your business and allow XRP to be listed on exchanges.

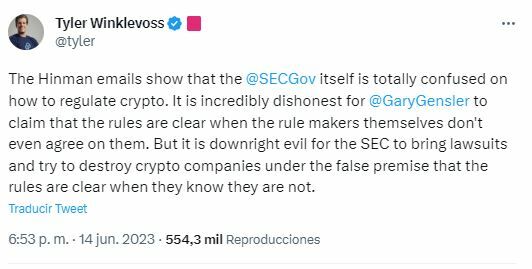

In particular, the recent disclosure of Hinmain’s emails (related to William Hinma’s famous 2018 ETH is not a security speech) has even revealed this SEC officials found the regulator’s guidance and statements on cryptocurrencies and crypto assets to be misleading.

Hence the publication of these emails supports Ripple’s argument that it did not receive a fair notice from the securities regulatorwhich some observers have also claimed It has not been shown that XRP investors had a reasonable expectation of profit.

Such events make Ripple’s situation look quite promising, and if the company achieves the desired result, XRP will come out for sure.

There is some evidence that the Whales make this assumptionwith a recent transfer of 100 million XRP This suggests that larger investors are looking to acquire the altcoin.

If Ripple secures something like a profit, XRP could easily retreat to $1with a return to bullish conditions later in the year, so could it help you transition to $2.

ripple The price is 0.4891 cents on Monday afternoon, the increase can be seen. The 70 SMA is below the last two bars, the RSI is at 48 points and the fast line (blue) of the MACD is below the slow one (red) towards zero.

The medium-term resistance stands at 0.565 cents.

Sign up for Critoactivos, NFTs and Metaverso’s weekly newsletter for free