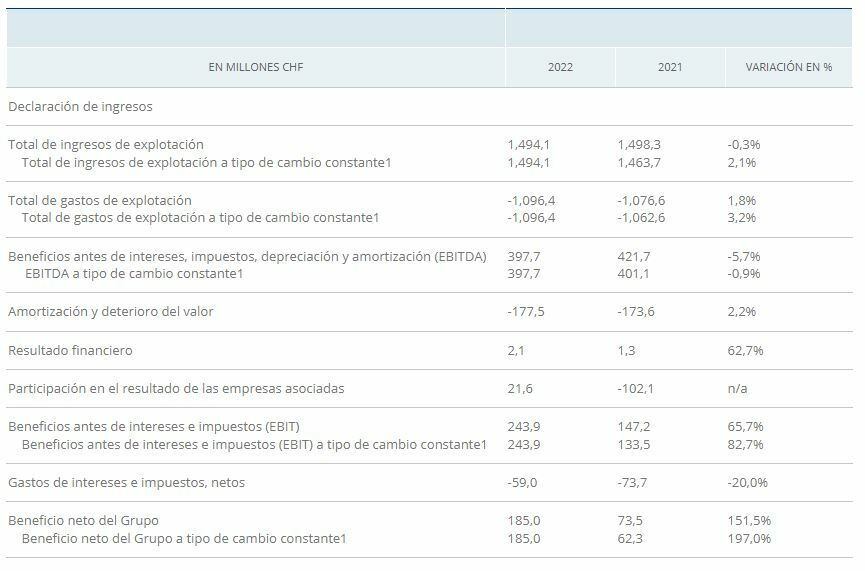

Despite the complexity of the environment SIX “Growth in most of its business areas at a constant exchange rate,” highlights BME in a statement. Operating profit was CHF 1,494.1 million (-0.3% at reference exchange rate, +2.1% at constant exchange rates), while earnings before interest, taxes, depreciation and amortization (EBITDA) were strong at CHF 397.7 million stayed the same (-5.7% at benchmark exchange rates, -0.9% at constant exchange rates with a margin of 26.6%).

Earnings before interest and taxes (EBIT) rose to CHF 243.9 million (+65.7% in reference currencies, +82.7% currency-adjusted). The Group’s net profit was 185.0 million Swiss francs (2021: 73.5 million Swiss francs).

:

“Despite the difficult market conditions, we have achieved solid results,” he emphasized. Jos Dijsselhof, CEO of SIX. “For an international market infrastructure operator like us, it is essential that our customers and all market participants can trust us at all times. We continuously invest in new and better services, as well as in our infrastructure and security. We are shaping the Swiss and Spanish capital markets for the future and making them the preferred markets for our clients worldwide.”

Financial and business prospects

Despite a complex 2022 and negative external factors, SIX remains true to its growth strategy. The group expects revenue growth of more than 4% per year over the medium term, driven by specialized initiatives such as SDX and digital assets, revenue synergies from the acquisition of BME and growth from its financial information business.

Profitability remains a priority for SIX. An optimized cost base is achieved by leveraging the characteristics of the business primarily associated with fixed costs, the cost synergies from the BME acquisition and other specific cost measures. Profitability is expected to increase due to higher sales and an optimized cost base.