last week a Bot of the MEV or maximum extractable value exhausted $25 million within the blockchain of tether. That’s why the company made the decision add it to the black list. This draws strong criticism from decentralization advocates like Polygon, suggesting that it sets a bad precedent Prashant Jha on Cointelegraph.

The address in question exploited a bug in MEV Boost Relay to trick MEV bots trying to perform a sandwich swap. Sandwiching occurs when one order is placed immediately before the trade and another immediately after. Essentially, the trader will execute early and late at the same time, sliding the original pending transaction in between.

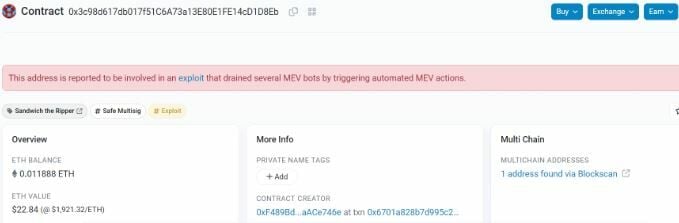

In this case, the red validator address rushed to execute the MEV transaction, resulting in this Nearly $25 million in losses in various digital assetsmaking it the largest MEV exploit to date. ether scan He has already tagged the address with a warning about his involvement in the exploit.

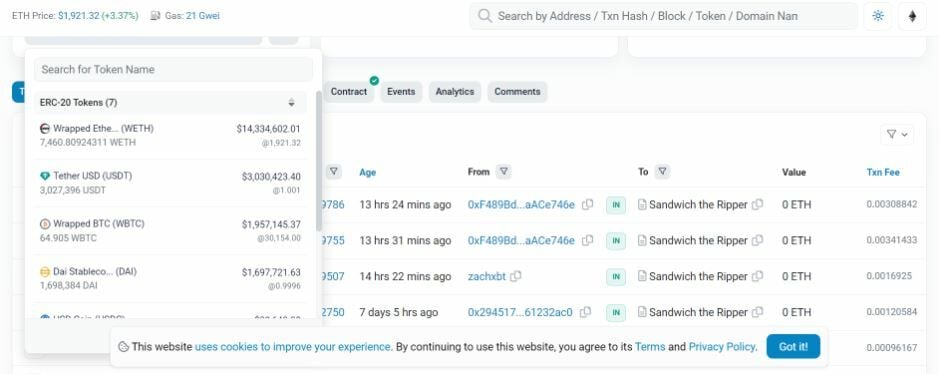

Had the USDT address around $3 million in USDT at the time of the blacklist and overall Various other ERC-20 tokens worth $21 million.

Blacklisting the red validator address drew some resistance from the community due to their censorship approach. Arthur, an engineer at crypto exchange KrakenHe called the blacklisting “nonsense,” recalling that MEV bots also take advantage of traders and that the sandwich trade they attempted to execute was just as nefarious as losing their funds.

“MEV bots exploit transfers and all is well, but someone does it to them and they get blacklisted?”

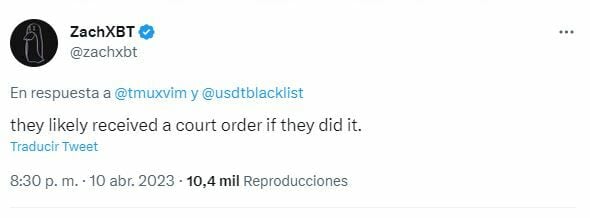

Another chain detective who is known by the Twitter covers ZachXBT said that the Tether blacklist could be the result of a court order. Cointelegraph reached out to Tether to confirm the same, but received no response at press time.

Jaynti Kanani, co-founder of Polygon, called Tether’s action a “bad precedent”

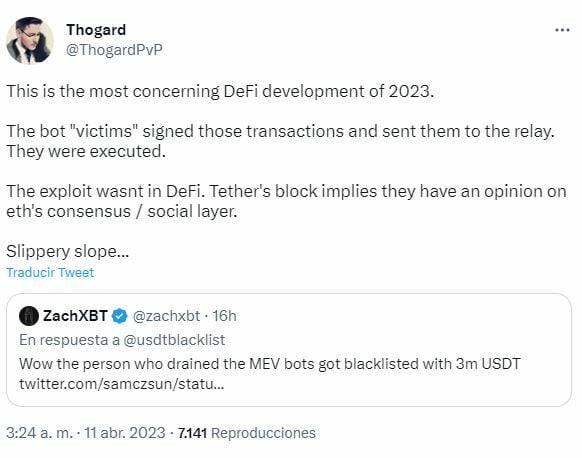

Meanwhile he Jordan, co-founder of Fastlane Labs Hagan, called it that “Most Worrying DeFi Development 2023”. He added that the main issue here is Tether’s readiness block or unblock “large numbers based on activity at the consensus level (beacon chain).”

The MEV bots make more money by using information about transactions to be executed. Arbitration is very often used for this purpose. (exploitation of price differences between exchanges).

When a The MEV bot notices that someone else is planning to buy a coin and positions itself to take advantage of the slight price increase its bid is likely to cause. The bot will lead the trade, skip the queue and buy the coin for a little less. Then him bot By stops trading and buys the cryptocurrency for a little less.

MEV bot practices are often described as a invisible tax form. Recently, a A total of 27 Ethereum-based projects came together to launch MEV Blocker. The aim of the MEV blocker is to minimize the value extracted by traders.

Sign up for Critoactivos, NFTs and Metaverso’s weekly newsletter for free