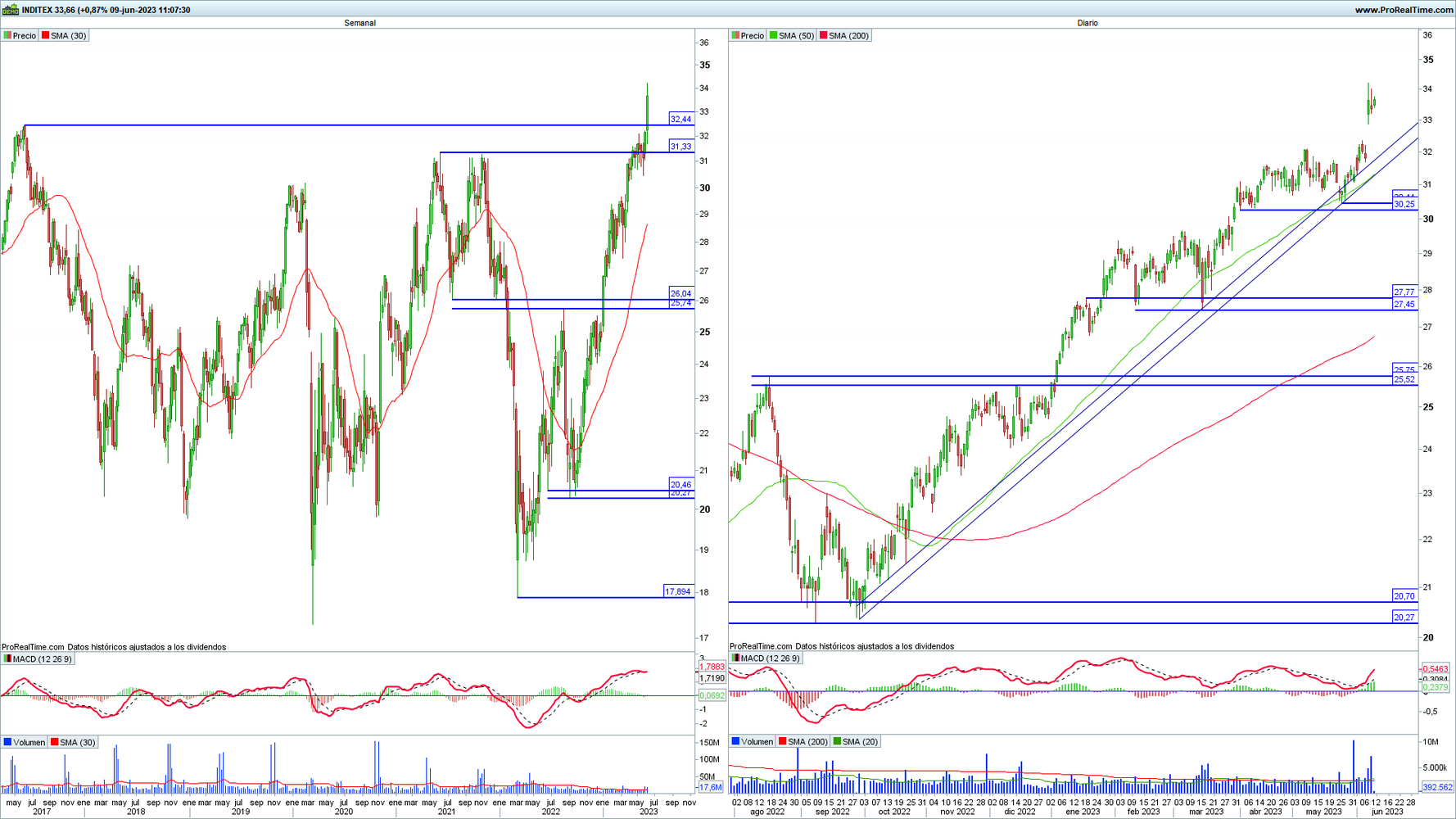

Inditex breaks the resistance and prepares for an uptrend

Inditex took center stage this week following the release of its quarterly results. This event has served as a catalyst for the company clearly breaching the area of significant resistance that we had previously identified and that is nearby €32.44 / €31.33 per share. This movement has enabled the activation of buy signals in the MACD oscillator in both the daily and weekly analysis, suggesting that the company is entering a phase of free rise. As long as Inditex manages to stay above the forecast support area of €30.44 / €30.25 per share, there will be no signs of exhaustion in the near term.

Prepare for a sustained uptrend

By overcoming important obstacles, Inditex has generated bullish momentum that could take the company to new highs. The MACD oscillator, a widely used technical indicator, has generated buy signals in both daily and weekly analysis, reinforcing the positive outlook for Inditex.

Consolidation of technical strength

Overcoming significant resistance, as Inditex has experienced, is a clear sign of technical prowess. This suggests that demand for the company’s shares is increasing, which in turn could attract more investors looking to take advantage of the upside.

Support analytics and price forecasting

From the current levels, The predicted support area is around €30.44 / €30.25 per share. If Inditex manages to stay above this support level, the company is likely to continue its uptrend in the near term. Investors should pay attention to these levels as they could serve as strategic entry points.

Short-term outlook and recommendations

The near-term outlook for Inditex is favourable. However, there is always a certain degree of uncertainty in the financial markets, which is why it is important to closely follow the development of the company and events in the industry.

Investors wishing to benefit from this uptrend are advised to carefully consider risk and capital management. It is important to have a solid investment plan and set stop-loss levels to protect accumulated profits.

Inditex on weekly (left) and daily (right) charts with MACD oscillator and trading volume

ArcelorMittal breaks barriers and heads for new bullish targets

ArcelorMittal has managed to fix its price above the bearish guideline originating from the yearly highs, and thus also exceeds the most recently determined falling maximum value of €25 per share. This surge was supported by the buying reaction, aided by positive divergences in the daily MACD oscillator. As a result, the bullish targets are updated and the next forecasted middle resistance area is in sight from €27.74 / €27.40 per share.

Overcoming obstacles and updating bullish targets

ArcelorMittal has succeeded in breaking down significant market barriers. The share price has managed to establish itself above the bearish guideline derived from the year highs, which is a positive sign for the company. In addition, the most recently determined falling maximum value of €25 per share was exceeded.

This surge was supported by buying that showed positive divergences in the daily MACD oscillator. These divergences suggest that the stock price has bullish momentum. Consequently, the bullish targets are updated and the next middle resistance area is forecast, which comes in at €27.74 / €27.40 per share.

Positive outlook on the next resistance area

By overcoming key obstacles, ArcelorMittal has proven its strength in the market. The bullish move supported by positive divergences in the daily MACD oscillator opens the way for new opportunities. The bullish targets are updated and the next middle resistance area is projected.

Analysts believe that ArcelorMittal shares have short-term upside potential a target in the price range of €27.74 to €27.40 per share. However, it is important to emphasize that the success of this prediction depends on the company’s ability to sustain the bullish momentum and clear the resistance area.

In summary, ArcelorMittal managed to break key barriers and move towards new bullish targets. Confirmation of positive divergences on the daily MACD oscillator supports this move and provides an encouraging outlook for the company in the near-term.

ArcelorMittal on weekly (left) and daily (right) charts with MACD oscillator and trading volume

Aena faces challenges and could change the trend in the short term

Aena has recently explored the secondary rising guideline traced off the October lows. This break is a sign of weakness Supported by several factors: (1) cumulative overbought levels on the weekly MACD, (2) sell signals activated on the same oscillator in recent weeks, and (3) bearish divergences on the daily MACD oscillator. Therefore, a scenario is proposed that puts the feasibility of the recently increasing minimum value of €139.2 per share to the test. Drilling at this level would be the next step in confirming a trend reversal Next down targets are €134.5 / €131.55 per share.

Weakness and possibility of a trend reversal at Aena

Aena faces challenges in the market. It recently broke the secondary or intermediate-term rising guideline off the lows recorded in October. This break is a sign of the company’s weakness and is supported by various technical indicators.

First, they were observed cumulative overbought levels on the weekly MACDThis suggests that the stock price was overvalued compared to its uptrend. Additionally, the same MACD oscillator has been generating sell signals for the past few weeks, indicating more downward pressure. Finally, bearish divergences were spotted on the daily MACD oscillator, signaling a potential lack of bullish momentum.

In view of this situation, a scenario is proposed in which the feasibility of the recently increasing minimum value of €139.2 per share is put to the test. A break of this level would confirm a reversal in the downtrend with the next targets being €134.5 / €131.55 per share.

Bearish outlook and challenges ahead

Aena faces a pessimistic outlook in the near term. The breach of the secondary rise guideline and unfavorable technical indicators suggest that the company could see a trend reversal. In case the last rising minimum is projected Starting at €139.2 per share, the continuation of the downward trend would be confirmed.

In this scenario, they think The upcoming bearish targets are in the price range of 134.5 to 131.55 euros per share. These levels pose additional challenges for Aena and could affect the stock’s performance in the near term.

In summary, Aena is facing a challenging market situation, with signs of weakness supported by negative technical indicators. The next important step will be the break of the last predicted rising low, which would confirm a change in the downtrend.

Aena on weekly (left) and daily (right) charts with MACD oscillator and trading volume