BBVA is not only among the top five stocks to rise the most this year on the IBEX 35, but is also the company in its industry with the fastest gains in 2023, with its shares rising 32.61% year-to-date.

The company, led by Carlos Torres, released its results for the first three months of the year in the last week of April, which reflected: Profit of 1,846 million eurosalmost 40% more than in the same period last year, despite the bank tax in Spain.

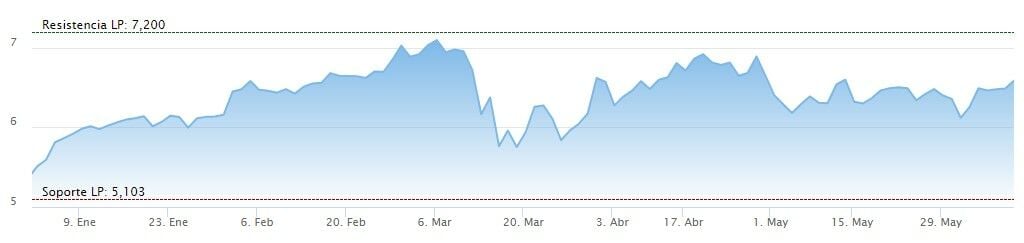

Last month, BBVA shares experienced a Upgrade greater than 16%. June started with a slight gain in stocks, despite the instability in Turkey, a country considered to be one of the company’s main areas of activity. 13% of the Group’s margins and 9% of its assets come from this market. The rapprochement with the Eurasian country becomes all the more apparent considering that the company’s current CEO, Onur Genç, was born and raised in the Ottoman country.

BBVA has been present in Turkey for 13 years and is even more evident through its subsidiary in the country, Garanti.

Despite chaining two consecutive negative days to close last week, Shares of the Spanish bank have been colored green in all sessions for the past five days. It was also announced this Friday that the company has launched a new employment portal, the aim of which is to attract technology profiles in different countries in its field of activity, with the aim of employing more than 2,600 professionals at the end of the year, including 1,000 in Spain.

The Reuters Analyst Consensus gives the financial institution a price target of 8.36 euros, up 10% since March, giving it a 12-month potential for Spanish bank 17.5%. Of the experts covering BBVA, 57% are committed to buying the stocks, while the remaining 43% prefer to ‘hold’ the stocks.

He BBVA’s current P/E ratio is 6.22, below the Ibex 35 average (currently at 8.33), this is one of the best in the range. If we compare the data to some of its peers, Banco Santander currently has a P/E ratio of 6.66 and Caixabank 8.73.

Earnings per share (EPS) is 1.12. The current PVC (book value price) is 0.79. On the other hand, the dividend yieldby BBVAis the highest in the industry within the Ibex 35 it is 6.18%, a value that is above competitors such as Banco Santander (4.28%) and very close to Caixabank (6.1%).