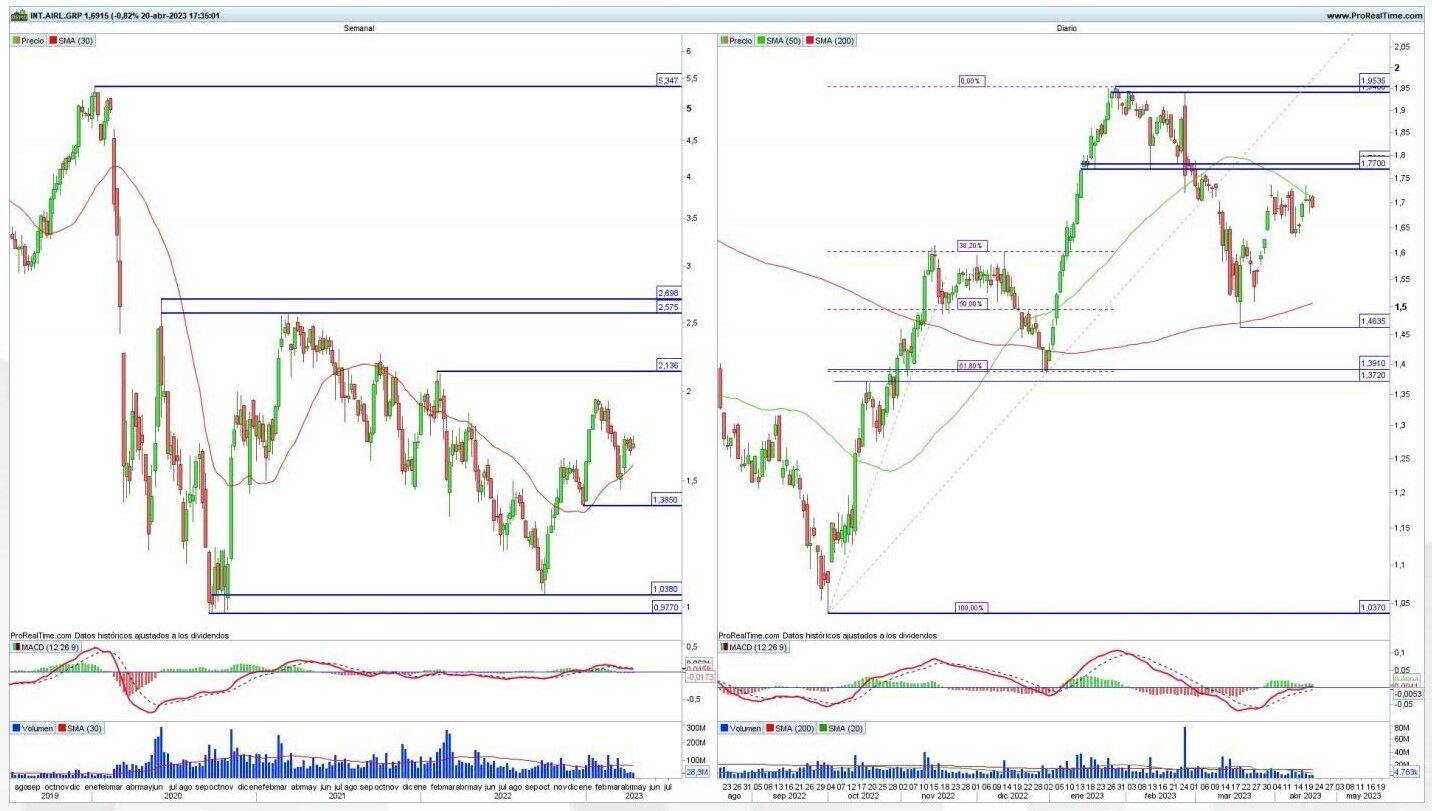

“IAG (Iberia) for the moment manages to maintain a structure with rising highs and lows that allows its 30-week simple moving average to reach a positive slope. With that in mind, the next target of buying is to 1 Attacking €.78, an area of former support, now resistance. For our part, we set the support to watch at €1.4635 per share,” explains analyst José Antonio González.

“The situation is not bad in the medium term (…), but in the short term it would be a mistake to think that the worst is over,” continues the analyst. It is necessary to watch the resistance of EUR 1,737, the last maximum and the level of EUR 1,764. For the lower part, on the other hand, it should respect the 1.4635 euros.

Currently, shares of IAG (Iberia) are above €1.67, making it difficult to perform below this support.

Analysts from companies like Banco Sabadell claim Recommendations for buying company shares, as they see “a lot of potential”. However, its price target is down around 6% in the past few days.

Factors such as the purchase of Air Europa have raised some doubts about the company’s financial position, but there are no issues due to maturities or cost increases, so IAG’s acquisition of Air Europa does not appear to make much of a difference.

The company is currently embroiled in a battle to preserve it BEATAlthough recently the Portuguese Prime Minister António Costa spoke out in favor of a takeover of the Portuguese airline by Lufthansa.

Since the beginning of 2023 the value of IAG (Iberia) on the stock market has grown by 21%, one of the stocks that performed best on the IBEX. The company has been able to safely regain pre-pandemic levels despite its slowness and consolidate positions.

As explained by Javier Alfayate, Manager of GPM Sociedad de Valores, IAG must respect the support at 1.67 euros and for now, it manages to remain bullish. Below this support, its appearance is complicated. If we are in value we can keep waiting to see if the trend helps and manages to gain ground. But once we’re out, “I’d wait for it to surpass last week’s highs by $1.75, thinking it might go to $1.95 later,” says the pundit.