While other hedge funds reduce or freeze their positions in Chinese Big Tech, Michael Burry, Founder of Scion Asset Management, does the opposite. The famous investor known as “The Big Short” Position long short in JD.com Sp ADR-A And Alibabaaccordingly Ye Xie on Yahoo Finance.

The two actions have become larger holdings from Scion Asset Managementrepresents the 20% of your stock portfolio. Their success depends not only on companies regaining their mojo, but also on weathering the geopolitical risks that have driven many of their competitors away.

Burry, best known for predicting the 2008 housing crash, made headlines Monday when he disclosed in a 13F filing that he snapped up regional lenders during the first-quarter banking crisis.

That wasn’t his only opposing bet. After Buy Alibaba and JD.com in the final months of 2022 when China ended the Covid zero policy, Burry increased stocks of the last two quarters. your participation in JD.com has more than tripled to 250,000 shares worth $11 million. or the 11% of your portfolio. In addition, stocks were doubled Alibaba to 10 millionof dollars.

The vote of confidence came as many of his peers sold shares. As a group, they are Hedge funds sold 4 million shares of JD.com, according to presentations 13F. The reduction of 451 millionof dollarswhich includes the change in stock valuation during the quarter, marked one of the largest declines among US-listed companies.

The Alibaba shares even rose 1.6% in Hong Kong Tuesday while JD.com rose 4.7%. The moves follow Monday’s rally in the index Nasdaq Golden Dragon Chinaas Alibaba’s promise of “huge” investments in its shopping app Taobao and US Securities and Exchange Commission approval of its 2022 financial report also boosted confidence.

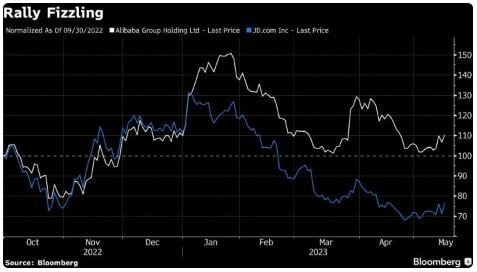

Overall, however, the so-called reopening measures were disappointing. He The MSCI China Index was flat over the year, as the economy shows signs of losing momentum. He China’s consumer spending and industrial activity grew slower than expected in Aprilshowed data on Tuesday that underscores this recovery weakness.

The Hedge fund net exposure to China fell to 10.5% from 13.3% in Januaryaccording to unit data Goldman Sachs Group Prime Services.

JD and Alibaba have not fared well since their reopening rally stalled in late January. The actions of US-listed JDs are down 32% this yearwhile Alibaba hasn’t changed much, even if he made a historical review. Last week, JD reported the lowest revenue growth in its history.

The Earnings estimates for the Hang Seng Tech Index fell to near record lows as fierce competition in the e-commerce space puts pressure on margins. The Alibaba’s first-quarter results are scheduled for Thursdayand analysts estimate a Sales increase of less than 3%. This is a far cry from the pre-pandemic go-go days and Beijing’s crackdown on big tech in 2021.

Burry made a name for himself as an opponent and that hasn’t changed. In that case, you can bet the fears about China Inc. are overdone.

Alibaba it closed Monday at $88.44 in the uptrend and the 70 and 200 period moving averages are above the last three candles. Meanwhile, the egg indicators are mixed.

JD.com Sp ADR-A it closed yesterday at $37.64, also in an uptrend, and the 70 and 200 period moving averages remain above the price. Meanwhile, the egg indicators are also mixed.