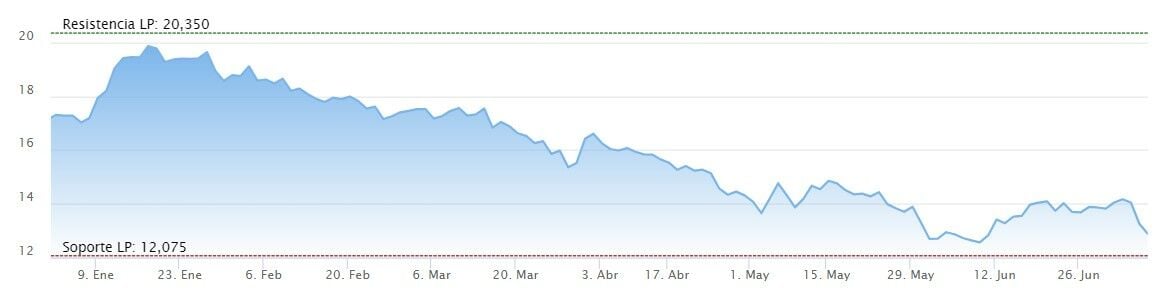

Solaria takes the place in the IBEX 35 that nobody wants. And it is that the renewable energy company is at the bottom of the 35 values of the Spanish selective in terms of annual cumulative value. In particular, the institution, chaired by Enrique Díaz-Tejeiro, notes that: Shares down 24%.

Despite the fact that the company’s stocks were up just over a percentage point on Friday morning, it wasn’t a week that the corporate ranks would remember at least well. Despite posting a 0.85% gain on Monday, Solaria shares fell sharply in the Wednesday and Thursday sessions, down 5.6% and 2.8%, respectively.

These cuts were favored by the measure announced in the PP’s election program to introduce a renewable energy tax, which “will be collected by the project promoter and will finance the increase in funds that the administration needs to speed up the management of the files” , to a to avoid bureaucratic collapse.”

Renta 4 Analysts consider this measure to be negative for the sector because “although the measure aims to unlock the process of issuing permits, the introduction of new fees does not address the root of the problem (most of the processing is in the hands of small businesses) . municipalities) and only represents new hurdles for the project promoters”. Acciona Energías Renovables was also one of the Ibex stocks with the most setbacks after receiving this information.

Of course, Solaria’s potential is in the double digits. At least that’s how they see it the consensus of Reuters analystswhich gives the Spanish company a shot after cutting its price target by 5.25% over the last three months from €19.97 to the current €18.92 12-month potential of 45%using the price of its shares at Thursday’s close as a reference.

In addition, 47% of the experts who follow the company recommend the shares as a buy, 35% prefer to hold and the remaining 18% decide to sell the shares.

The main indicators include the Solaria’s P/E ratio is 14.63, well above the Ibex average, which currently stands at 8.08. If we compare this data to the P/E of its main competitor in the selective space, Acciona Energías Renovables is very similar at 14.26.

Solaria’s earnings per share (EPS) are 0.88, below Acciona Energías Renovables’ 1.94. However, Solaria’s PVC value (book value price) is higher, reaching 3.61 compared to 1.47 for the competitor.