Wall Street’s tech megacaps like Apple, Amazon, Alphabet or Meta (Facebook) are accelerating in the stock market relative to the rest of the US stock market at a time marked by turbulence in the financial sector and expectations of the Fed not only halting rate hikes, but even start reducing at the end of the year.

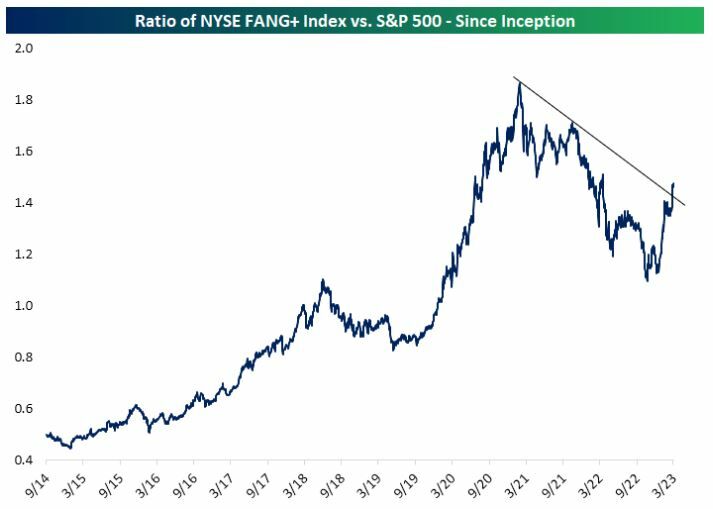

This is shown by an analysis prepared by the Bespoke Investment Group NYSE FANG+ index, which includes the largest and most traded technology and related companies. In recent days this group of values has reached its highest level since last AprilMeanwhile heS&P500 still has to climb 4% to reach its February high.

The NYSE FANG+ is an index composed of the big technology stocks with an equal dollar weight. These include Meta (Facebook), Apple, Amazon, Netflix, Alphabet, as well as others like Alibaba, Baidu, NVIDIA, Tesla, and Twitter (before it was taken down by Elon Musk).

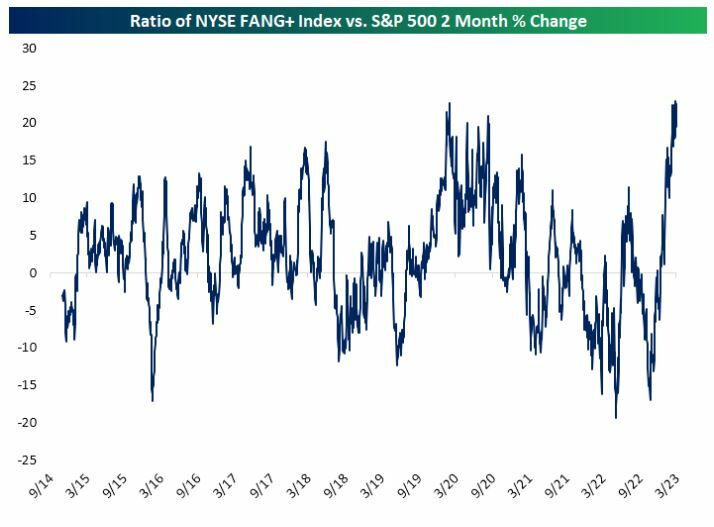

“While FANG+ shares have been strong recently, they have been doing so since then more than a year returns below expectations“, recall experts from the Bespoke Investment Group. Compared to the S&P 500, tech megacaps have “consistently” underperformed from February 2021 through last fall. Over the past few days, the tremendous outperformance has translated into a downtrend break in the relationship between the FANG+ and the S&P 500.

“The most impressive thing is the speed with which the movement took place,” say the experts. Since peaking this week, the ratio was up 22.5% over the previous two months. This digit is just below the record (22.6%) that led to the pre-Covid-19 high in February 2020. In other words, “They achieved near-record-breaking performance compared to the broader market. However, it should be noted that this comes after the group posted some of its worst bi-monthly results over the past year, with the worst readings being recorded in March, May and November.

And in the heat of these great stocks, the NASDAQ 100 is proving to be the great resilience of the major New York indices. It’s not a book bounce but with the one falling at the moment the markets more than nervous about everything happening in the monetary policy spiced financial system the truth is that the selective technological indicator is starting to make a difference.

It stands out among the other indicators in the week, month, quarter and even this year so far. If we look at its performance when there are only a few sessions left until the end of March, it gains by 16.8%. Already for the year, its gains remain well into the double digits, with increases of 17%.