He The European Central Bank has to raise interest rates further in view of persistent core inflationand its next move could be a 25 or 50 basis point hike, Boštjan Vasle, a member of the ECB’s Governing Council, said on Thursday.

The ECB has hiked rates by a record 350 basis points since July, but policymakers say the work is not done even if inflation falls quickly, as pressure on prices and wage growth continues – as fast as in the not in recent years.

“We need to tighten monetary policy further,” Vasle, head of Slovenia’s central bank, told Reuters on the sidelines of the IMF’s spring meeting. “It’s too early to determine the pace of our next move, but the options I’m considering are 25 and 50 basis points up.”

“The Headline inflation recedesbut we are all focused on core inflation, which continues to move in the wrong direction,” Vasle said.

Despite these messages being circulated by some members of the ECB, the market is predicting that the end of rate hikes is near and rate cuts will happen soon.

Meanwhile, on the other side of the Atlantic, various authorities are on the side The Federal Reserve examined the possibility of suspending rate hikes until it was clear that the failure of two regional banks would cause no further financial strain, but even they concluded at their last meeting that the priority was still high inflation.

According to the minutes of the meeting of the Federal Open Market Committee on April 21/22, published on Wednesday, the development of the financial sector could affect lending and the development of the economy.

However, those authorities, along with others, agreed that the actions taken by US policymakers and the Federal Reserve “have helped calm banking sector conditions and reduce near-term risks to economic activity and inflation.” and supported a quarter-point rate hike.

Goldman Sachs economists they no longer expect the US Federal Reserve to raise interest rates in June, according to an analytical note released on Wednesday after data showing consumer prices cooled faster-than-expected in March.

Previously, Goldman Sachs had expected two consecutive rate hikes at the Fed’s May and June meetings, and the company’s economists, led by Jan Hatzius, said in the release that they still expect a rate hike in May.

The market is discounting the possibility of rate hikes of 70% at the May meeting and then two or three rate cuts later in the year.

Although the ECB continues to lag behindall indications are that it could follow its counterpart and cut rates sometime next year.

Accordingly Antonio Castelo, iBroker Market Specialistthere are still a few months left for rate cuts, but it seems clear that neither the Fed nor the ECB have any rate hikes left.

Two companies benefited within the Ibex 35

Within the IBEX 35 there are two companies that could be the winners of these rate cuts. They were particularly punished in 2022: These are Cellnex and Grifols.

In the case of Cellnex, it has reclaimed 21% of the ground so far this year. Grifols, on the other hand, is very low. But in both cases both have positive points: good positioning of their business, diversification and high cash flow. But the doubts come from the side of his high level of debt.

If a halt to the interest rate hike process is confirmed, “which we will see in May or June at the latest”, both will benefit, since interest rate hikes make it more expensive to refinance their debt. A breather is good for them and helps their business.

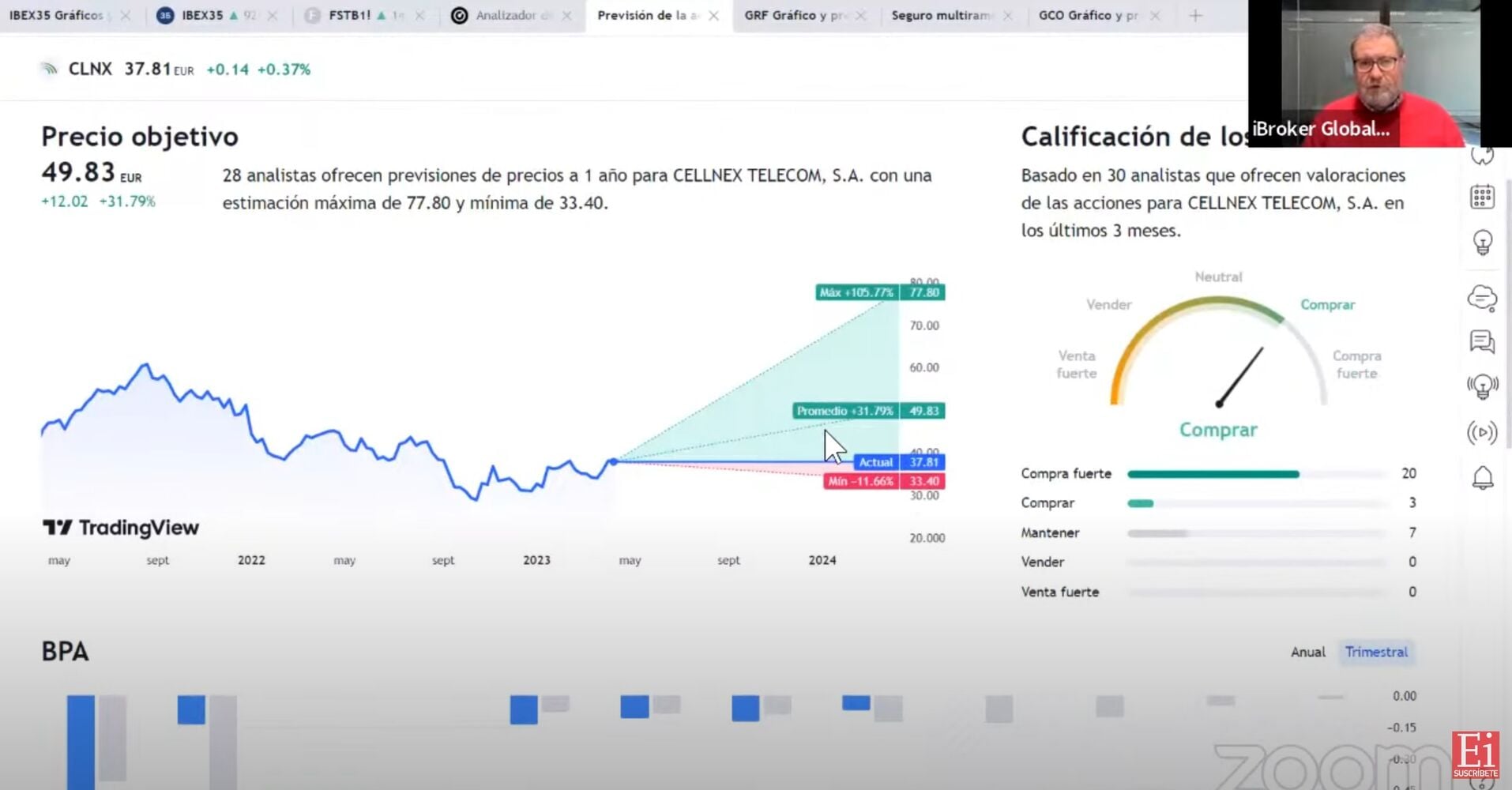

For Cellnex, the analyst consensus gathered by Reuters has a Buy rating and a price target of €49.83, giving it an upside potential of 31%.

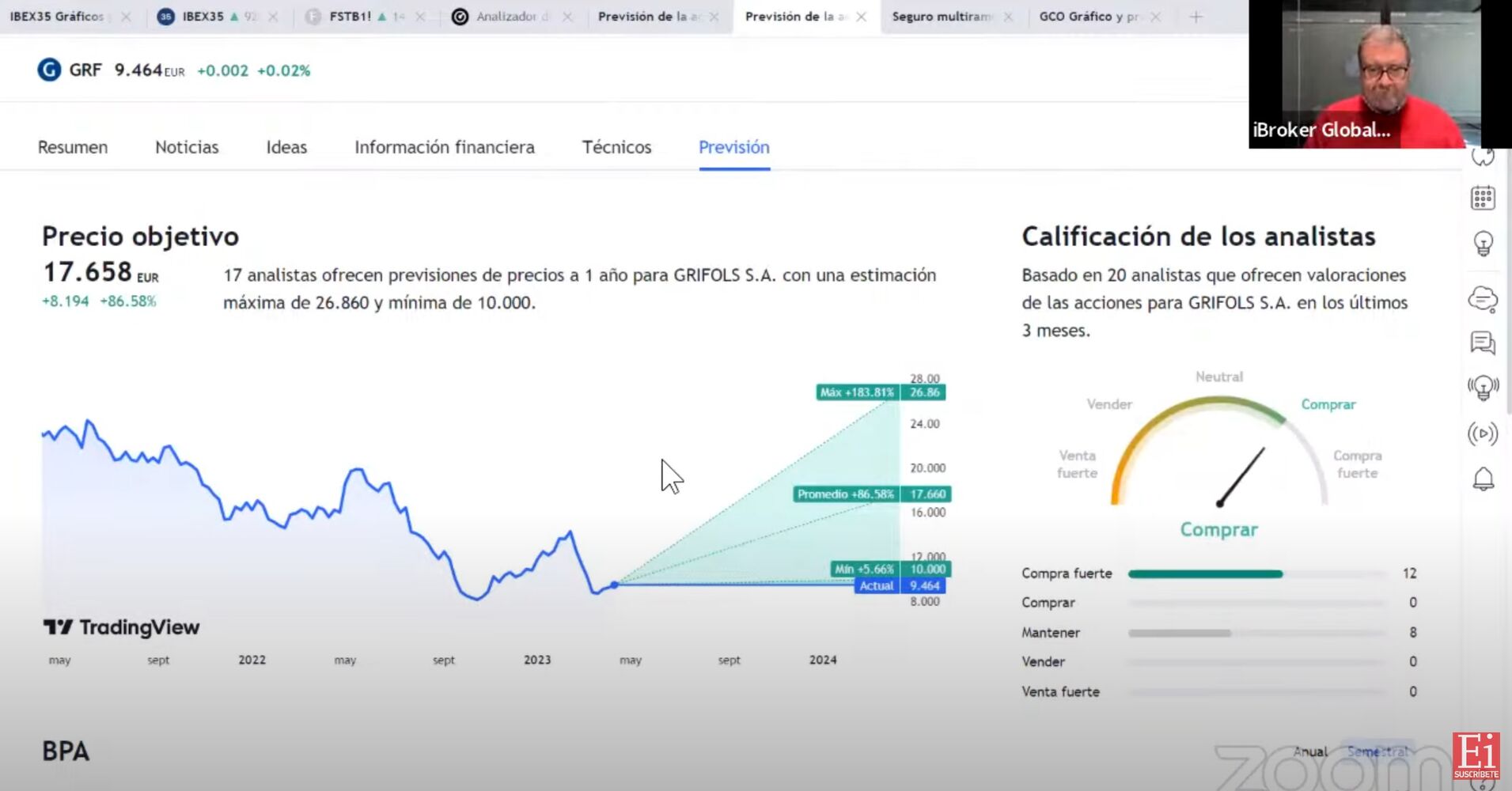

For Grifols, the price target of EUR 17.65 specified by the consensus results in a potential of 86%, also with a buy recommendation.